GainzAlgo V2 Alpha VS MOST POPULAR Buy/Sell Trading Indicators in 2025

In the ever-evolving landscape of trading, selecting the right indicators is crucial for success. With a plethora of tools available, traders often find themselves overwhelmed. This article delves into a comparative analysis of GainzAlgo V2 Alpha against other popular buy/sell trading indicators in 2025, highlighting their features, performance, and suitability for various trading strategies.

Understanding GainzAlgo V2 Alpha

GainzAlgo V2 Alpha is an advanced trading indicator designed for use on TradingView. It provides real-time BUY and SELL signals, aiming to assist traders in making informed decisions across multiple markets, including forex, crypto, and stocks. Key features include:

- Real-Time Signals: Offers immediate buy and sell alerts without lag.

- No Repainting: Ensures that once a signal is given, it doesn’t change, maintaining historical accuracy.

- Multi-Market Compatibility: Suitable for various markets and timeframes.

- User-Friendly Interface: Designed for both beginners and experienced traders.

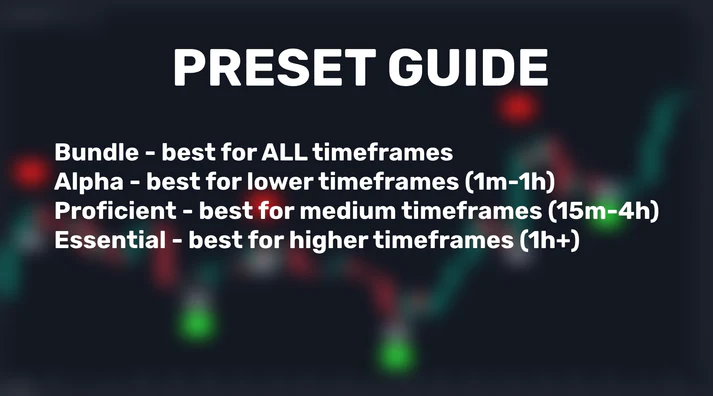

The Alpha preset is particularly noted for its performance on lower timeframes, providing precise entry and exit points.

Comparing with Other Popular Indicators

Let’s examine how GainzAlgo V2 Alpha stacks up against other widely used trading indicators:

1. Moving Averages (MA)

- Function: Calculates the average price over a specific period, smoothing out price data.

- Pros: Simple to use; helps identify trends.

- Cons: Lagging indicator; may provide delayed signals.

2. Relative Strength Index (RSI)

- Function: Measures the speed and change of price movements to identify overbought or oversold conditions.

- Pros: Useful for spotting potential reversals.

- Cons: Can generate false signals in trending markets.

3. MACD (Moving Average Convergence Divergence)

- Function: Shows the relationship between two moving averages of a security’s price.

- Pros: Helps identify momentum and trend direction.

- Cons: May lag in volatile markets; complex for beginners.

4. Bollinger Bands

- Function: Uses standard deviation to create bands above and below a moving average.

- Pros: Indicates volatility and potential price reversals.

- Cons: May produce false signals during strong trends.

5. GainzAlgo V2 Alpha

- Function: Provides real-time, non-repainting buy/sell signals using a proprietary algorithm.

- Pros: High accuracy; adaptable to various markets; user-friendly.

- Cons: Requires a TradingView account; premium version involves a cost.

Performance and User Feedback

Users have reported a high win rate with GainzAlgo V2 Alpha, often peaking over 75%. Its ability to provide clear signals without lag or repainting has been highlighted as a significant advantage over traditional indicators.

Visual Comparison

To better understand the differences, here’s a comparative table:

| Indicator | Type | Lagging/Leading | Repainting | Ease of Use | Market Compatibility |

|---|---|---|---|---|---|

| Moving Averages | Trend-Following | Lagging | No | Easy | All Markets |

| RSI | Momentum | Leading | No | Moderate | All Markets |

| MACD | Trend/Momentum | Lagging | No | Moderate | All Markets |

| Bollinger Bands | Volatility | Lagging | No | Moderate | All Markets |

| GainzAlgo V2 Alpha | Signal-Based | Leading | No | Easy | All Markets |

Video Demonstration

For a practical demonstration and in-depth analysis, watch the following video:

Conclusion

While traditional indicators like MA, RSI, MACD, and Bollinger Bands have their merits, GainzAlgo V2 Alpha offers a comprehensive solution with real-time, accurate signals suitable for various markets. Its user-friendly interface and high performance make it a valuable tool for traders aiming to enhance their strategies in 2025.

Leave a Reply